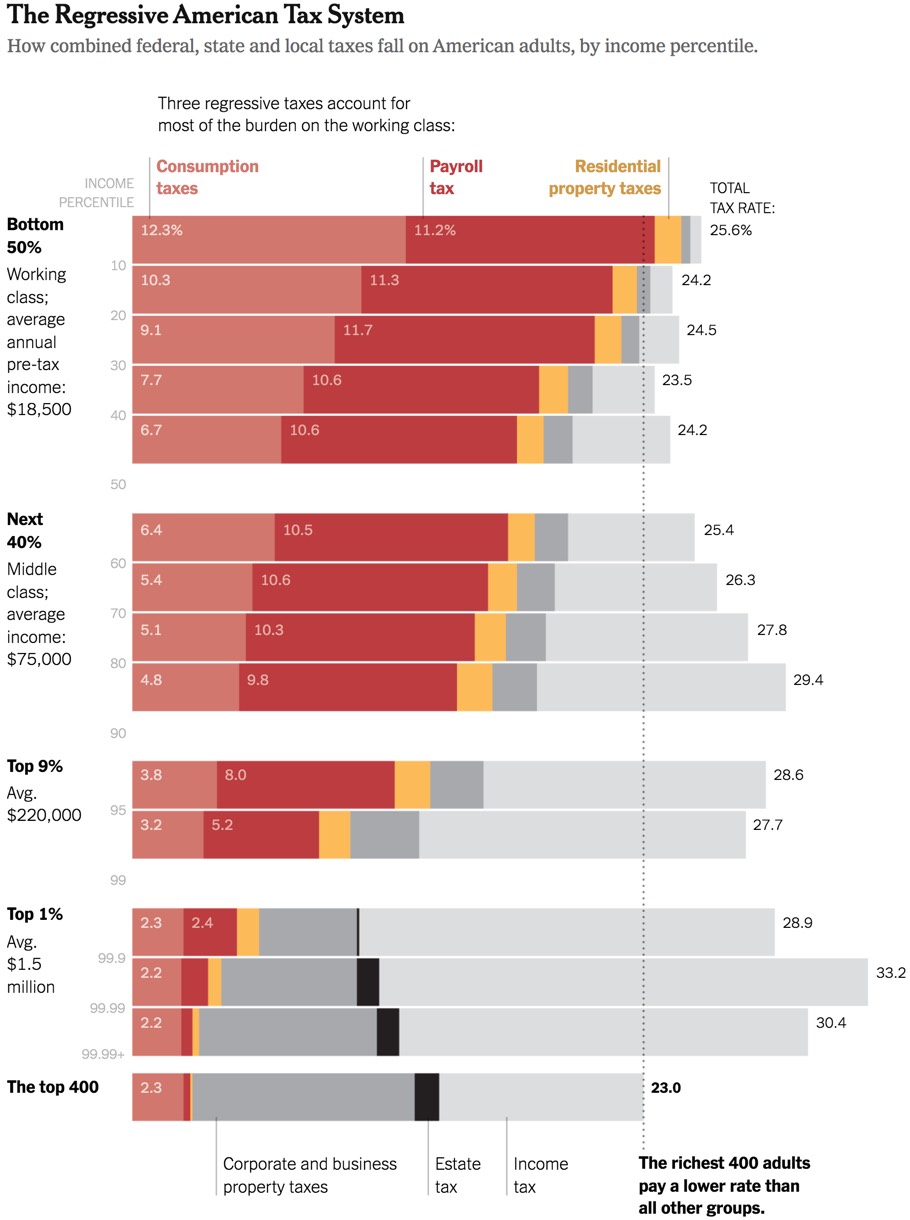

Have you read David Leonhardt’s exposé in the N.Y. Times “The Rich Really Do Pay Lower Taxes Than You“? According to Mr Leonhardt: “For the first time on record, the 400 wealthiest Americans last year paid a lower total tax rate–spanning federal, state, and local taxes–than any other income group ….” What this selective quotation does not tell you, however, is that the overall tax rate on the richest 400 households last year was “only” 23 percent and that the top 1% paid the highest total tax rate (between 29 and 30 percent)! So, why not get rid of all taxes and replace our current complicated and convoluted system with a “single tax“? (In case you are wondering, here is a list of the 400 wealthiest Americans.)

We should enact the Fair Tax.